2023 Housing Market Forecast

What does 2023 hold for the housing market? Here's what experts have to say about what lies ahead.

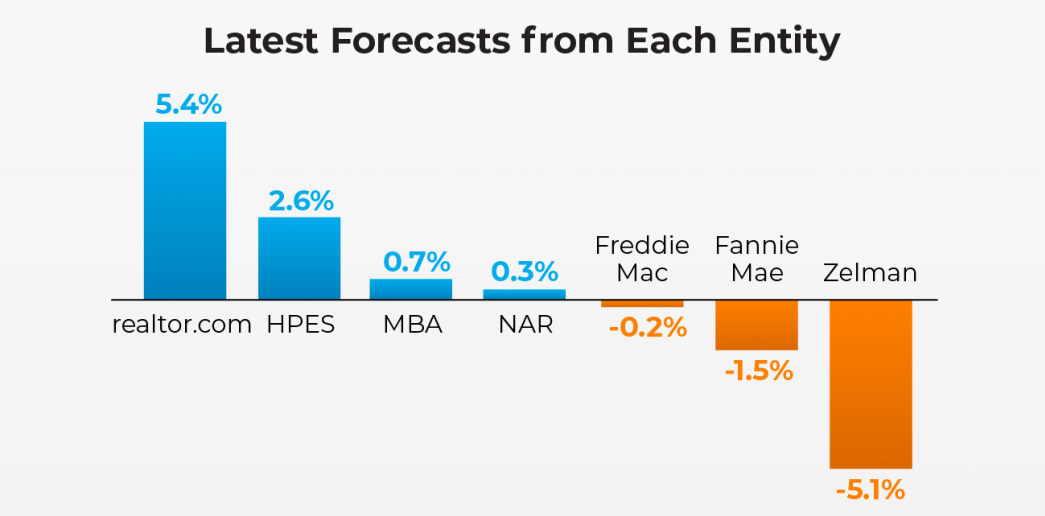

Home Price Appreciation Will Vary

Some experts call for slight appreciation and some call for slight depreciation on a national level.

In short, home price appreciation will vary by local market. It's all about supply and demand. But, the average is neutral price appreciation for the country.

Mortgage Rates Will Respond to Inflation

Where mortgage rates will go from here largely depends on what happens with inflation in the year ahead. Greg McBride, a Chief Financial Analyst from Bankrate said:

"...mortgage rates could pull back meaningfully next year if inflation pressures ease."

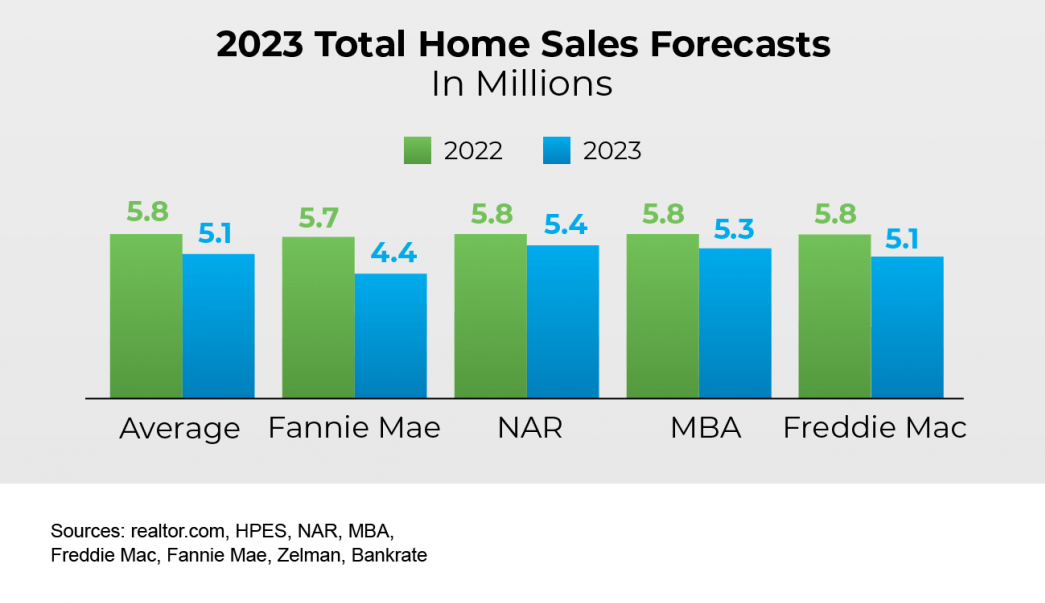

Home Sales Will Moderate

Home sales are projected to be lower than 2022 due to higher mortgage rates that have moderated buyer demand.

Some Highlights

- From home sales to prices, the 2023 housing market will be defined by mortgage rates. And where rates go depends on what happens with inflation.

- If you’re thinking of buying or selling a home this year, let’s connect so you understand where the housing market is headed in 2023.

Sources:

- realtor.com

- Home Price Expectations Survey (HPES)

- National Association of Realtors (NAR)

- Mortgage Bankers Association (MBA)

- Fannie Mae

- Freddie Mac

- Zelman & Associates

- Greg McBride, Chief Financial Analyst, Bankrate

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. All information in this blog is pulled from Keeping Current Matters, Inc., which does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.